The Anti-Money Laundering Software Market sector is undergoing rapid transformation, with significant growth and innovations expected by 2028. In-depth market research offers a thorough analysis of market size, share, and emerging trends, providing essential insights into its expansion potential. The report explores market segmentation and definitions, emphasizing key components and growth drivers. Through the use of SWOT and PESTEL analyses, it evaluates the sector’s strengths, weaknesses, opportunities, and threats, while considering political, economic, social, technological, environmental, and legal influences. Expert evaluations of competitor strategies and recent developments shed light on geographical trends and forecast the market’s future direction, creating a solid framework for strategic planning and investment decisions.

Brief Overview of the Anti-Money Laundering Software Market:

The global Anti-Money Laundering Software Market is expected to experience substantial growth between 2024 and 2031. Starting from a steady growth rate in 2023, the market is anticipated to accelerate due to increasing strategic initiatives by key market players throughout the forecast period.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-anti-money-laundering-software-market

Which are the top companies operating in the Anti-Money Laundering Software Market?

The report profiles noticeable organizations working in the water purifier showcase and the triumphant methodologies received by them. It likewise reveals insights about the share held by each organization and their contribution to the market's extension. This Global Anti-Money Laundering Software Market report provides the information of the Top Companies in Anti-Money Laundering Software Market in the market their business strategy, financial situation etc.

Accenture, SAS Institute Inc., Fiserv, Inc, Open Text Corporation, Experian Information Solutions, Inc., Oracle, FICO TONBELLER, Ascent Business, EastNets, Trulioo, BAE Systems, ACI Worldwide, Inc., Actimize, NameScan, Verafin Inc., LexisNexis, INETCO Systems Ltd, Global RADAR, Experian plc

Report Scope and Market Segmentation

Which are the driving factors of the Anti-Money Laundering Software Market?

The driving factors of the Anti-Money Laundering Software Market are multifaceted and crucial for its growth and development. Technological advancements play a significant role by enhancing product efficiency, reducing costs, and introducing innovative features that cater to evolving consumer demands. Rising consumer interest and demand for keyword-related products and services further fuel market expansion. Favorable economic conditions, including increased disposable incomes, enable higher consumer spending, which benefits the market. Supportive regulatory environments, with policies that provide incentives and subsidies, also encourage growth, while globalization opens new opportunities by expanding market reach and international trade.

Anti-Money Laundering Software Market - Competitive and Segmentation Analysis:

**Segments**

- **Deployment**: The global anti-money laundering software market can be segmented based on deployment into cloud-based and on-premises solutions. Cloud-based solutions are gaining popularity due to their scalability, cost-effectiveness, and ease of implementation. On-premises solutions, on the other hand, offer greater control and security for organizations with specific compliance requirements.

- **Component**: The market can be segmented based on components into software and services. The software segment includes solutions for transaction monitoring, customer due diligence, regulatory reporting, and sanctions screening. Services encompass consulting, implementation, and support services to ensure optimal utilization of the software solutions.

- **End-User**: In terms of end-users, the anti-money laundering software market caters to various industries such as banking, financial services, insurance, gaming, healthcare, and retail. Each sector has unique compliance requirements and risk profiles, driving the demand for tailored anti-money laundering solutions.

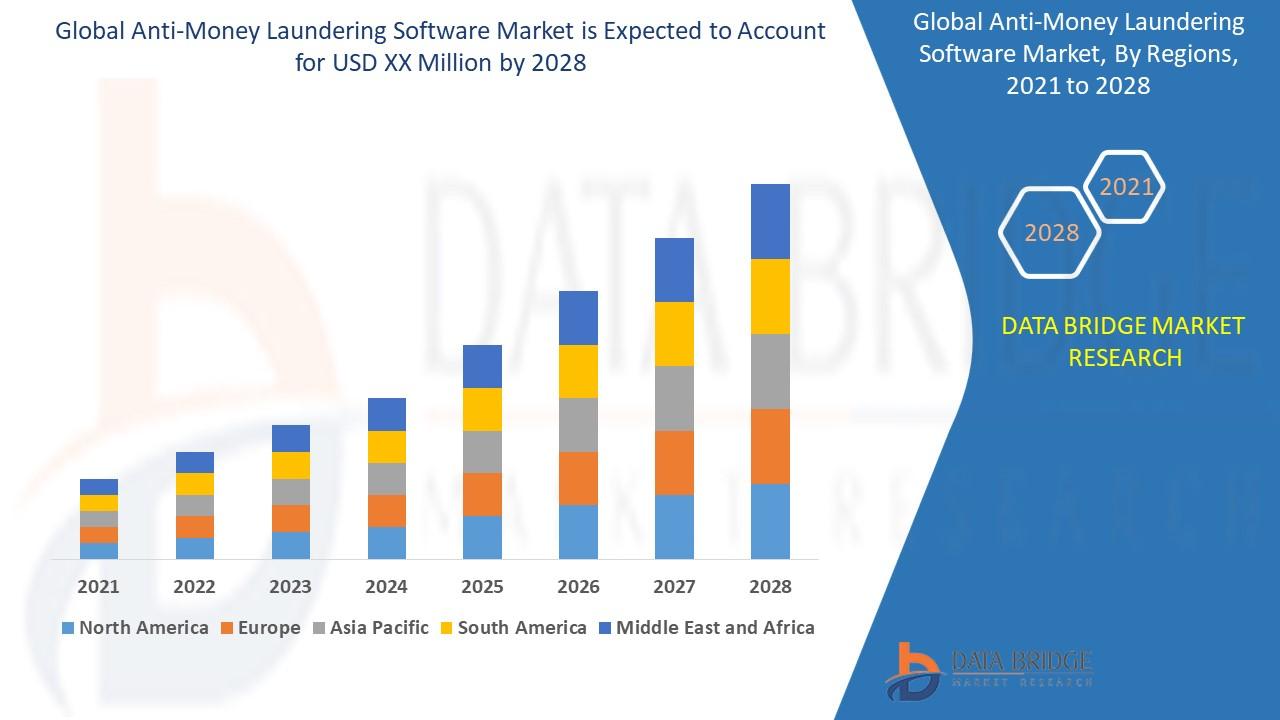

- **Region**: Geographically, the market can be segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America is a key market for anti-money laundering software due to stringent regulatory frameworks and high incidences of financial crimes. Asia Pacific is projected to witness significant growth attributed to increasing digitalization and focus on regulatory compliance in emerging economies.

**Market Players**

- **ACI Worldwide, Inc.**: ACI Worldwide offers a comprehensive suite of anti-money laundering solutions that help organizations detect and prevent financial crimes. Their advanced analytics and machine learning capabilities enhance fraud detection and regulatory compliance.

- **Oracle Corporation**: Oracle provides anti-money laundering software that enables real-time monitoring of transactions, customer risk profiling, and sanctions screening. Their solutions are designed to streamline compliance processes and mitigate financial risks effectively.

- **SAS Institute, Inc.**: SAS Institute offers AI-driven anti-money laundering solutions that enable predictive analytics for identifying suspicious activities. Their platform integrates seamlessly with existing systems to provide a holistic view of financial transactions and customer behavior.

- **NICE Actimize**: NICE Actimize specializes in cloud-based anti-money laundering solutions with advanced detection capabilities and dynamic risk scoring. Their platform leverages AI and machine learning to adapt to evolving financial crime patterns and regulatory requirements.

- **FICO**: FICO provides end-to-end anti-money laundering solutions that combine behavioral analytics, machine learning, and consortium data to detect complex financial crimes. Their scalable platform caters to diverse industry verticals and compliance needs.

For more detailed information and insights on the global anti-money laundering software market, visit: https://www.databridgemarketresearch.com/reports/global-anti-money-laundering-software-marketThe global anti-money laundering software market continues to evolve as organizations across various industries prioritize regulatory compliance and financial crime prevention. One significant trend shaping the market is the increasing adoption of advanced technologies such as artificial intelligence, machine learning, and cloud computing. These technologies enable more sophisticated approaches to detecting and preventing money laundering activities, as they can analyze large volumes of data in real-time and identify complex patterns indicative of suspicious behavior. Moreover, the shift towards cloud-based solutions is driven by the need for scalability, agility, and cost-efficiency, especially in light of the growing digitalization of financial transactions and the need for remote access to compliance tools.

In addition to technology trends, the market is also influenced by regulatory developments and enforcement actions aimed at combating money laundering and terrorist financing. Regulatory bodies worldwide are imposing stricter requirements on financial institutions and other businesses to enhance their anti-money laundering protocols and reporting capabilities. This has led to an increased demand for comprehensive anti-money laundering software solutions that can help organizations stay compliant with evolving regulations while effectively managing financial risks.

Another key factor impacting the market is the increasing awareness among businesses about the importance of anti-money laundering measures in safeguarding their reputation and avoiding legal repercussions. The high-profile cases of money laundering scandals in recent years have underscored the need for robust compliance programs and advanced monitoring tools to detect suspicious activities. As a result, companies are investing in sophisticated anti-money laundering software that can provide them with the necessary capabilities to identify and prevent illicit financial transactions.

Furthermore, the market is witnessing a surge in strategic partnerships and collaborations among software providers, financial institutions, and regulatory bodies to foster innovation and knowledge sharing in the fight against financial crimes. These partnerships aim to leverage collective expertise, data resources, and technology solutions to enhance the effectiveness of anti-money laundering efforts on a global scale. By working together, stakeholders in the anti-money laundering ecosystem can create more robust and resilient systems to combat illicit financial activities and protect the integrity of the financial system.

Overall, the global anti-money laundering software market is poised for continued growth and innovation as organizations strive to stay ahead of evolving threats and regulatory challenges. With the convergence of advanced technologies, regulatory imperatives, and industry collaboration, the market is expected to witness new opportunities for solution providers to develop cutting-edge tools and services that can effectively address the complex and dynamic nature of financial crimes. Key players in the market will need to focus on enhancing their offerings with advanced analytics, automation capabilities, and integration features to meet the evolving needs of businesses across sectors and geographies.**Segments**

Global Anti-Money Laundering Software Market, By Component (Software, Service), Product (Transaction Monitoring, Currency Transaction Reporting, Customer Identity Management, Compliance Management), Deployment Type (Cloud, On-Premises), Organization Size (SMEs, Large enterprises), End User (BFSI, Defense and Government, Healthcare, IT and Telecom, Retail, Transportation and Logistics, Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2028.

The global anti-money laundering software market is witnessing significant growth driven by various factors such as increasing regulatory requirements, rising financial crimes, and the adoption of advanced technologies. The market segmentation based on components including software and services reflects the diverse offerings available to cater to specific needs within organizations. Transaction monitoring, customer identity management, and compliance management are crucial products in the fight against money laundering. The deployment options of cloud and on-premises solutions provide organizations with flexibility in choosing the best-fit infrastructure. Additionally, catering to different organization sizes and end-users ensures that the anti-money laundering software market serves a wide range of industries and compliance requirements across various regions globally.

**Market Players**

- Accenture

- SAS Institute Inc.

- Fiserv, Inc

- Open Text Corporation

- Experian Information Solutions, Inc.

- Oracle

- FICO TONBELLER

- Ascent Business

- EastNets

- Trulioo

- BAE Systems

- ACI Worldwide, Inc.

- Actimize

- NameScan

- Verafin Inc.

- LexisNexis

- INETCO Systems Ltd

- Global RADAR

- Experian plc

The competitive landscape of the global anti-money laundering software market is characterized by the presence of key players offering a wide range of solutions to combat financial crimes effectively. These market players are focused on innovation, strategic partnerships, and continuous development to meet the evolving demands of organizations for comprehensive anti-money laundering software. The integration of advanced technologies like artificial intelligence, machine learning, and predictive analytics in anti-money laundering solutions has become a norm to enhance detection capabilities and ensure regulatory compliance. Collaborations between software providers, financial institutions, and regulatory bodies play a vital role in addressing the complex challenges posed by money laundering activities. Moreover, the emphasis on data security, scalability, and user-friendly interfaces has become crucial for market players to differentiate themselves and provide value-added services to their customers. Moving forward, the market players are expected to continue investing in research and development to stay ahead in the rapidly changing landscape of anti-money laundering software solutions and cater to the growing needs of organizations globally.

North America, particularly the United States, will continue to exert significant influence that cannot be overlooked. Any shifts in the United States could impact the development trajectory of the Anti-Money Laundering Software Market. The North American market is poised for substantial growth over the forecast period. The region benefits from widespread adoption of advanced technologies and the presence of major industry players, creating abundant growth opportunities.

Similarly, Europe plays a crucial role in the global Anti-Money Laundering Software Market, expected to exhibit impressive growth in CAGR from 2024 to 2028.

Explore Further Details about This Research Anti-Money Laundering Software Market Report https://www.databridgemarketresearch.com/reports/global-anti-money-laundering-software-market

Key Benefits for Industry Participants and Stakeholders: –

- Industry drivers, trends, restraints, and opportunities are covered in the study.

- Neutral perspective on the Anti-Money Laundering Software Market scenario

- Recent industry growth and new developments

- Competitive landscape and strategies of key companies

- The Historical, current, and estimated Anti-Money Laundering Software Market size in terms of value and size

- In-depth, comprehensive analysis and forecasting of the Anti-Money Laundering Software Market

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

The countries covered in the Anti-Money Laundering Software Market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA

Detailed TOC of Anti-Money Laundering Software Market Insights and Forecast to 2028

Part 01: Executive Summary

Part 02: Scope Of The Report

Part 03: Research Methodology

Part 04: Anti-Money Laundering Software Market Landscape

Part 05: Pipeline Analysis

Part 06: Anti-Money Laundering Software Market Sizing

Part 07: Five Forces Analysis

Part 08: Anti-Money Laundering Software Market Segmentation

Part 09: Customer Landscape

Part 10: Regional Landscape

Part 11: Decision Framework

Part 12: Drivers And Challenges

Part 13: Anti-Money Laundering Software Market Trends

Part 14: Vendor Landscape

Part 15: Vendor Analysis

Part 16: Appendix

Browse More Reports:

Japan: https://www.databridgemarketresearch.com/jp/reports/global-anti-money-laundering-software-market

China: https://www.databridgemarketresearch.com/zh/reports/global-anti-money-laundering-software-market

Arabic: https://www.databridgemarketresearch.com/ar/reports/global-anti-money-laundering-software-market

Portuguese: https://www.databridgemarketresearch.com/pt/reports/global-anti-money-laundering-software-market

German: https://www.databridgemarketresearch.com/de/reports/global-anti-money-laundering-software-market

French: https://www.databridgemarketresearch.com/fr/reports/global-anti-money-laundering-software-market

Spanish: https://www.databridgemarketresearch.com/es/reports/global-anti-money-laundering-software-market

Korean: https://www.databridgemarketresearch.com/ko/reports/global-anti-money-laundering-software-market

Russian: https://www.databridgemarketresearch.com/ru/reports/global-anti-money-laundering-software-market

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 1495