The size of global environmental monitoring market in terms of revenue was estimated to be worth USD 14.7 billion in 2024 and is poised to reach USD 18.6 billion by 2029, growing at a CAGR of 4.9% from 2024 to 2029.

The environmental monitoring market size is witnessing a significant surge, fueled by escalating concerns regarding environmental degradation and regulatory mandates worldwide. With industries facing mounting pressure to curb pollution levels, the demand for advanced monitoring solutions continues to rise. Technological innovations in sensor technologies and data analytics are driving the evolution of monitoring systems, enabling real-time tracking of air, water, and soil quality.

Key Players:

As of 2023, prominent players in the environmental monitoring market are Agilent Technologies (US), Danaher Corporation (US), Thermo Fisher Scientific (US), Shimadzu Corporation (Japan), PerkinElmer (US), 3M (US), Emerson Electric Co. (US), bioMérieux S.A. (France), Honeywell International Inc. (US), Merck KGaA (Germany), Siemens AG (Germany), and Forbes Marshall (India), among others.

Environmental Monitoring Market Size Insights:

The environmental monitoring market size is witnessing a significant surge, fueled by escalating concerns regarding environmental degradation and regulatory mandates worldwide. With industries facing mounting pressure to curb pollution levels, the demand for advanced monitoring solutions continues to rise. Technological innovations in sensor technologies and data analytics are driving the evolution of monitoring systems, enabling real-time tracking of air, water, and soil quality.

Amidst rapid urbanization and industrial expansion, the environmental monitoring market size is poised for sustained growth. Governments are allocating substantial budgets for environmental protection initiatives, fostering market expansion further. This upward trajectory is expected to persist as stakeholders prioritize sustainability and compliance with environmental standards.

Environmental Monitoring Market Share Dynamics:

In the fiercely competitive landscape of environmental monitoring, market share dynamics are shaped by strategic alliances, product innovation, and geographic expansion. Leading players are leveraging partnerships and acquisitions to consolidate their market presence and enhance their offerings. Moreover, the advent of IoT and AI technologies is revolutionizing monitoring practices, driving market share growth for companies embracing these advancements.

While established markets in North America and Europe command significant market share, emerging economies in Asia-Pacific are witnessing rapid adoption of monitoring solutions. This geographical diversification underscores the need for companies to adapt to regional nuances and tailor their strategies to capture market share effectively. As the industry evolves, staying agile and proactive in responding to market dynamics will be paramount for sustaining and expanding market share.

By product, the monitors segment accounted for the largest share of the environmental monitoring industry during the forecast period.

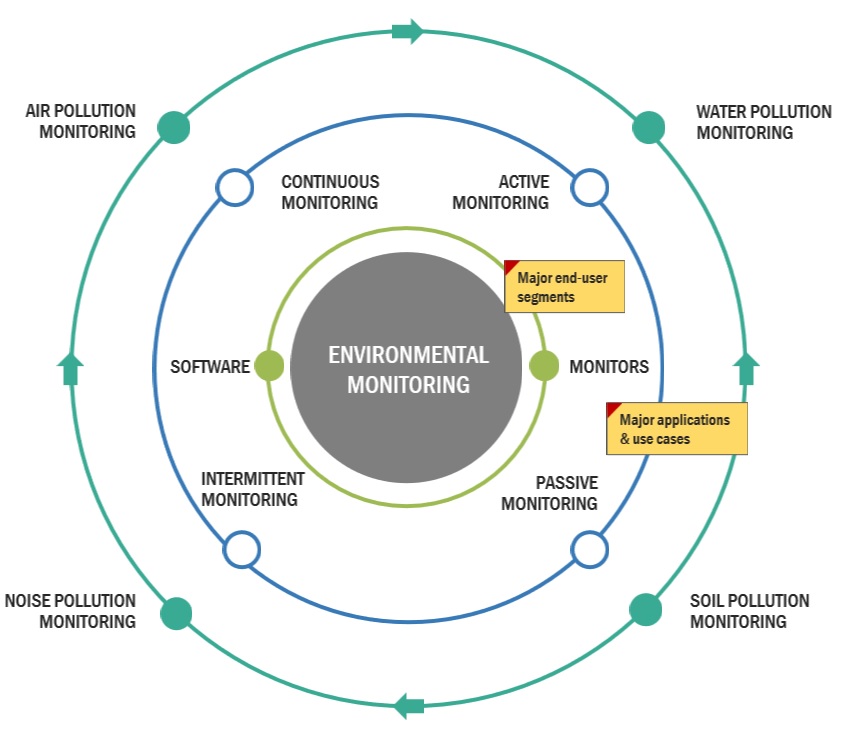

Based on the product, the environmental monitoring is segmented into monitors and software. Environmental monitors are further sub-segmented into indoor monitors, outdoor monitors, and portable monitors. The monitors segment accounts for the largest share of the environmental monitoring market. The increase in industry adoption of pollution monitoring strategies also the continuous development and commercialization of outdoor environment monitoring sensors and increasing public awareness contribute to the large share.

By sampling method, the continuous monitoring segment of the environmental monitoring industry is expected to grow at the highest rate during the forecast period.

Based on the sampling method, the environmental monitoring market is divided into active, passive, intermittent, and continuous monitoring. In 2024, the continuous monitoring segment is projected to hold the biggest market share throughout the forecast period. This growth is driven by growing focus on the development of eco-friendly industries, the need for real-time sample monitoring and the increasing environmental pollution levels in major regions worldwide.

By application, the air pollution monitoring segment of the environmental monitoring industry is expected to witness significant growth during the forecast period.

Based on the application, the environmental monitoring market is divided into air pollution monitoring, noise pollution monitoring, water pollution monitoring and soil pollution monitoring. Within water pollution monitoring segment there are sub-segments including wastewater monitoring and surface & groundwater monitoring. The air pollution monitoring segment is expected to witness significant growth during the forecast period. The growing acceptance and demand for sensor-based air quality monitoring systems have led to the significant growth and dominance of the segment in the industry in the upcoming years.

North America is expected to be the environmental monitoring industry largest market during the forecast period.

The environmental monitoring market has been segmented into five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America, comprising the US and Canada, held the largest share of the global environmental monitoring market in 2023. This region is witnessing growth due to growing government initiatives in pollution control, technological advancements in environmental sensors, increased government funding to establish environmental monitoring stations and stringent regulations supporting the greater adoption of pollution monitoring technologies.

On the other hand, the Asia-Pacific market is projected to experience the most significant growth rate throughout the forecast period. North America held the largest market share for environmental monitoring at 50.6%, trailed by Europe at 25.5%.

Recent Developments of The Environmental Monitoring Industry:

- In March 2024, Emerson Electric co. launched Rosemount 3490 Controller that helps to optimize processes, enhance sustainability and ensure regulatory compliance for water and wastewater applications

- In December 2021, Honeywell International Inc. announced a user-friendly monitor that alerts users when indoor air conditions may present an increased risk of potentially transmitting airborne viruses.

- In February 2021, 3M invested $1 Billion to achieve carbon neutrality, reduce water use, and improve water quality

Content Source:

https://www.marketsandmarkets.com/Market-Reports/environmental-monitoring-market-216846315.html

https://www.marketsandmarkets.com/PressReleases/environmental-monitoring.asp